Valid MB-310 Dumps shared by PassLeader for Helping Passing MB-310 Exam! PassLeader now offer the newest MB-310 VCE dumps and MB-310 PDF dumps, the PassLeader MB-310 exam questions have been updated and ANSWERS have been corrected, get the newest PassLeader MB-310 dumps with VCE and PDF here: https://www.passleader.com/mb-310.html (343 Q&As Dumps)

BTW, DOWNLOAD part of PassLeader MB-310 dumps from Cloud Storage: https://drive.google.com/open?id=1T0aRKKPZq4mi2lMl-DzV0wAUTYC-MPX1

NEW QUESTION 236

A client wants general journals to be used only to post ledger-type transactions. You need to set up journal configuration to achieve the requirement.

Solution: Set up the journal control on the general journal to the account type of ledger.

Does the solution meet the goal?

A. Yes

B. No

Answer: A

Explanation:

A journal name can be used only for adjustments. In this case, you can specify that only the Ledger account type is valid across all companies.

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/general-journal-processing

NEW QUESTION 237

You are managing credit and collections. You need to set up mandatory credit limits for all customer documents.

Solution: Define a credit limit for each customer and select the Mandatory credit limit check box on the Customers form.

Does the solution meet the goal?

A. Yes

B. No

Answer: B

Explanation:

https://docs.microsoft.com/en-us/dynamics365/supply-chain/sales-marketing/credit-limits-customers

NEW QUESTION 238

You need to configure cash flow reports. Which three actions should you perform? (Each correct answer presents part of the solution. Choose three.)

A. Configure the behavior for forecasts of transactions that affect the liquidity accounts of the company.

B. Identify and list all the liquidity accounts.

C. Define the number sequence.

D. Configure the account structure.

E. Run the cash flow calculation process.

Answer: ABE

Explanation:

To obtain a forecast of the cash flow, you must complete the following tasks:

– Identify and list all the liquidity accounts. Liquidity accounts are the company’s accounts for cash or cash equivalents.

– Configure the behavior for forecasts of transactions that affect the company’s liquidity accounts.

After you’ve completed these tasks, you can calculate and analyze forecasts of the cash flow and upcoming currency requirements. The forecasting process uses transaction information that is entered in the system, and the calculation process forecasts the expected cash impact of each transaction.

https://docs.microsoft.com/en-us/dynamics365/finance/cash-bank-management/cash-flow-forecasting

NEW QUESTION 239

You are implementing Dynamics 365 Finance. Sales tax payable must be posted to the same collection of accounts across all legal entities. You need to configure the sales tax. What should you use?

A. Posting group.

B. Tax jurisdiction.

C. Use tax payable account.

D. Tax group.

Answer: A

Explanation:

You can set up Ledger posting groups for sales tax. Sales tax is calculated and posted to main accounts that are specified in Ledger posting groups. Ledger posting groups are attached to each sales tax code. You can set up individual ledger posting groups for each sales tax code, use one ledger posting group for all sales tax codes or assign multiple ledger posting groups to the sales tax codes.

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/tasks/set-up-ledger-posting-groups-sales-tax

NEW QUESTION 240

You are implementing Dynamics 365 Finance. You must configure a more accurate cash flow forecast related to sales tax. The sales tax calculation should be based on the expected transaction amounts and dates. You need to configure the cash flow forecast. Which setup should you use?

A. Bridging accounts.

B. Sales forecast defaults.

C. Dependent accounts.

D. Purchasing forecast defaults.

Answer: B

Explanation:

Cash flow forecasting can be integrated with General ledger, Accounts payable, Accounts receivable, Budgeting and inventory management. The forecasting process uses transaction information that is entered in the system, and the calculation process forecasts the expected cash impact of each transaction. Note: In the Purchasing forecast defaults section, you can select default purchasing behaviors for cash flow forecasting. Three fields determine the time of the cash impact: Time between delivery date and invoice date, Terms of payment, and Time between invoice due date and payment date. The forecast will use the default setting for the Terms of payment field only if a value isn’t specified on the transaction. Use a term of payment to describe the most typical number of days for each part of the process. The Cash flow sales tax authority payments feature predicts the cash flow impact of sales tax payments. It uses unpaid sales tax transactions, tax settlement periods, and the tax period payment term to predict the date and amount of cash flow payments.

https://docs.microsoft.com/en-us/dynamics365/finance/cash-bank-management/cash-flow-forecasting

https://docs.microsoft.com/en-us/dynamics365-release-plan/2020wave1/dynamics365-sales/forecasting

NEW QUESTION 241

You plan to manage delinquent customers by monitoring the collection process in Dynamics 365 Finance. You need to use the Collections list page to monitor the collection process. What must you do first?

A. Set up customer groups.

B. Set up customer pools.

C. Update financials.

D. Age customer balances.

Answer: B

Explanation:

Customer pools are queries that define a group of customer records. You can use these grouped records to view information for the customer accounts that are included, and to manage collections or aging processes for them. You can use customer pools to filter information on the collections list pages. You also can use them to filter the customer accounts that are included when aging snapshots are created.

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/cm-collections-concepts

NEW QUESTION 242

You are the controller of a multi-entity organization that uses the same chart of accounts and fiscal periods across all entities. You use the financial report designer in Dynamics 365 Finance to create, maintain, deploy, and view financial statements. You need to generate consolidated financial statements by using a building block group to aggregate data across companies and financial dimensions. Which three actions should you perform? (Each correct answer presents part of the solution. Choose three.)

A. Create a column definition and use the period and year to map the appropriate periods for each company.

B. Create a row definition that includes all appropriate accounts in all companies in the rows.

C. Create a column definition that includes a financial dimension column for each company.

D. Create a reporting tree that includes a reporting node for each company.

E. Use the Reporting Unit field to select the tree and reporting unit for each column.

Answer: BCD

Explanation:

Single-level and multilevel consolidations across legal entities. The simplest method for consolidating by using Financial reporting is to use reporting trees to aggregate data across companies that have the same chart of accounts and fiscal periods. Here are the high-level steps to consolidate by using a reporting tree:

1. Create a row definition, and make sure that all appropriate accounts in all companies are included in the rows. (B)

2. Create a column definition that includes all the columns that are required for the report that you’re creating. (C)

3. Create a reporting tree that includes a reporting node for each company that you’re using on consolidated reports. (D)

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/generating-consolidated-financial-statements

NEW QUESTION 243

An exchange rate provider has been configured for Dynamics 365 Finance. Foreign currency transactions using the Euro and the US dollar use a fixed exchange rate for European Central Bank holidays and all days between April 1 and June 30. Foreign currency transactions from March 1 to June 30 fail to post. You need to reconfigure the system to post transactions for this period. Which two configuration changes should you make to the ledgers? (Each correct answer presents part of the solution. Choose two.)

A. Add a key named FloatCurrencies and set the value to True.

B. Set Create necessary currency pairs to True.

C. Set Import as of start date to Apr01.

D. Add a key named BaseCurrency and value of USD.

E. Set Prevent import on national holiday to True.

Answer: CD

Explanation:

Multiple records in different transaction currencies can be aggregated, compared, or analyzed with regard to a single currency, by using an exchange rate. This is known as the base currency. You first define a base currency for the organization and then define exchange rates to associate the base currency with transaction currencies. The base currency is the currency in which other currencies are quoted. The exchange rate is the value of a transaction currency equal to one base currency.

Incorrect:

Not E: Prevent import on national holiday- This check box manages the import of the exchange rate for public holiday’s date. For example, if you select this check box and use the European Central Bank as the exchange rate provider, the system will not update the exchange rate on a public holiday that is related to the current legal entity. This option might not be available for some providers.

https://docs.microsoft.com/en-us/dynamics365/customerengagement/on-premises/developer/transaction-currency-currency-entity

NEW QUESTION 244

A company uses Dynamics 365 Finance. The company is based in the United States and sells a product online. The product is shipped to the United States, Canada, and Mexico. The product is sourced from Brazil. Legal entities must be set up for each country/region. One ledger account must be used to track sales tax payable. You need to configure the system to track Use Tax. Which two parameters should you configure? (Each correct answer presents part of the solution. Choose two.)

A. single sales tax code for Brazil

B. ledger posting group

C. single sales tax code for the United States

D. taxation rule

E. tax code for each legal entity

Answer: BE

Explanation:

B: Set up ledger posting groups for sales tax. Required. Ledger posting groups define the main accounts for recording and paying sales taxes.

E: Set up sales tax codes. Required. Sales tax codes contain the tax rates and calculation rules for each sales tax. Sales tax codes are related to a sales tax settlement period and a ledger posting group.

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/indirect-taxes-overview

NEW QUESTION 245

The controller at a company has multiple employees who enter standard General ledger journals. The controller wants to review these journal entries before they are posted. Currently, journals entries are posted without review. You need to configure Dynamics 365 Finance to help set up a system led review process to meet the controller s needs. Which functionality should you configure?

A. a Ledger daily journal workflow that uses the organizational hierarchy for journal posting, associated with the General ledger journal name

B. a saved query in the Voucher inquiries form for the controller to view all general journals posted to the ledger

C. a manual journal approval with the journal assigned to the user group that the employees are assigned to

D. the controller’s security rote so that he has approval privileges for General ledger journals

Answer: A

Explanation:

Some organizations require that journals be approved by a user other than the person who entered the journal. To set up an approval process, you can create a workflow. A workflow represents a business process. It defines how a document flows through the system and indicates who must complete a task or approve a document.

https://docs.microsoft.com/en-us/dynamicsax-2012/appuser-itpro/set-up-general-ledger-workflows

NEW QUESTION 246

A company signs a four-year contract for an IT support project. The manager wants to know how the revenue amounts will be allocated across the four-year period. You need to implement a revenue schedule to determine the revenue amounts for each month. Which setup should you use?

A. 60 months

B. 48 months

C. 4 years

D. 4 months

Answer: B

Explanation:

A revenue schedule must be created for each occurrence that revenue can be deferred for. For example, if your organization offers support over six-month, 12- month, 18-month, and 24-month periods, you must create a revenue schedule for each period.

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/revenue-recognition-setup

NEW QUESTION 247

A client uses Dynamics 365 Finance for accounts receivable. You need to ensure that accounts receivable clerks add the wire number for electronic payments. Which item should you set up as mandatory in the method of payment?

A. bank transaction type

B. payment ID

C. payment reference

D. deposit slip

Answer: A

Explanation:

Enter the Bank transaction type to identify the type of payment used by your bank. The bank transaction type is used during the bank reconciliation process, and can make reconciliation easier.

Incorrect:

Not B: In the Method of payment field, enter an ID for the method of payment. The Method of payment ID is shown on invoices and payments, so make it descriptive enough to understand what type of payment is being recorded, and for what bank account.

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/tasks/establish-customer-method-payment

NEW QUESTION 248

A cable and internet company implements Dynamics 365 Finance. The primary line of business for the company is internet services. The company also sells routers and modems to customers for an additional one-time cost. You need to configure revenue recognition. What should you configure?

A. Create a revenue schedule for the internet service, router, and modem.

B. Configure the internet service as essential.

C. Configure the internet service, router, and modem as essential.

D. Create the router and modem sales to post to deferred revenue.

Answer: B

Explanation:

1. Essential – The item is a primary source of an organization’s revenue. This value is the default setting.

2. Nonessential – The item isn’t a primary source of an organization’s revenue. When the median price settings are used, the price is ‘carved out’ to the median price and then allocated.

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/revenue-recognition-setup

NEW QUESTION 249

You are configuring vendor collaboration security roles for external vendors. You manually set up a vendor contact. You need to assign the Vendor (external) role to this vendor. Which tasks can this vendor perform?

A. Activate or inactivate the association between a contact person and a vendor account.

B. Delete any contact person that they have created.

C. View and modify contact person information, such as the person’s title, email address, and telephone number.

D. View consignment inventory.

Answer: D

Explanation:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/supply-chain/procurement/set-up-maintain-vendor-collaboration

NEW QUESTION 250

You are implementing Dynamics 365 Finance. You configure an invoice validation policy to use three-way matching and use a three percent tolerance for invoice totals. A user enters a vendor invoice journal. The invoice validation policy is not applied. You need to troubleshoot the policy. What is the issue with the policy?

A. Validation is only performed on vendor invoice entries.

B. The tolerance percentage is too high.

C. Validation is only performed on invoice register entries.

D. Validation is configured to check for price and quantity.

Answer: A

Explanation:

Vendor invoice policies are run when you post a vendor invoice by using the Vendor invoice page and when you open the vendor invoice Policy violations page. You can also configure the vendor invoice workflow to run vendor invoice policies every time that you submit an invoice to workflow. Vendor invoice policies do not apply to invoices that were created in the invoice register or invoice journal. Invoice matching validation does not use vendor invoice policies, but is instead set up in the Accounts payable parameters page.

Incorrect:

Not C: Vendor invoice policies do not apply to invoices that were created in the invoice register or invoice journal.

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/tasks/set-up-vendor-invoice-policies

NEW QUESTION 251

A company uses Dynamics 365 Finance to manage billing and expenses for projects. Team members complete expense reports and submit the expense reports to a project manager for approval. Each expense report must contain expense lines for one project only. Expense reports that are submitted without a project specified must be rejected. You need to configure an expense report approval workflow. Which three actions should you take? (Each correct answer presents part of the solution. Choose three.)

A. Create an expenditure reviewers’ group in Expense management.

B. Create a user group for project managers and add all project managers to the group.

C. Create an expense report workflow.

D. Set up a condition to run an approval step only if the expense report has a project specified. Set the workflow assignment to Expenditure reviewers.

E. Set up an automatic action to reject expense report lines that do not have projects specified. Set the workflow assignment to Expenditure reviewers.

Answer: ACD

Explanation:

C: When you have finished entering all lines on the expense report and have attached receipts according to company policy, you must submit the expense report to a workflow.

D: If you are an expense approver, you are notified when an expense requires your attention. Some expense workflows might have conditional decisions, depending on the workflow configuration.

https://docs.microsoft.com/en-us/learn/modules/create-process-expense-reports/08-submit-to-workflow

https://docs.microsoft.com/en-us/learn/modules/create-process-expense-reports/09-approve-expense

NEW QUESTION 252

You work as a Financial Consultant. You have been hired by a company to manage the Microsoft Dynamics Finance 365 system. You need to configure the Microsoft Dynamics Finance system to spread costs from one cost object to one or more other cost objects by applying a relevant allocation base. Which of the following should you configure?

A. Cost allocation policy.

B. Cost behavior.

C. Cost elements.

D. Cost distribution.

Answer: D

Explanation:

https://docs.microsoft.com/en-us/dynamics365/finance/cost-accounting/terms-cost-accounting

NEW QUESTION 253

You work as the Finance Manager for a company. The company uses Microsoft Dynamics 365 Finance for its accounting system. You need to ensure that when creating sales orders, the sales tax is automatically calculated when an item is added to a sales order line. Which two of the following fields must be populated in the sales order line to ensure the sales tax is calculated? (Choose two).

A. Item group.

B. Customer sales tax group.

C. Item sales tax group.

D. Sales tax code.

Answer: BC

NEW QUESTION 254

A company uses Microsoft Dynamics 365 Finance. The company purchases, creates, and acquires fixed assets by using purchase orders. The system must acquire the fixed asset when a vendor invoice is posted. You need to process the transaction. What should you do?

A. Select a procurement category in a purchase order line and leave the fixed asset group blank.

B. Manually create a fixed asset before the fixed asset number is added to the purchase order.

C. Leave the fixed asset number blank on the purchase order.

D. Run a fixed asset acquisition proposal before a fixed asset number can be added to a purchase order.

Answer: B

Explanation:

https://docs.microsoft.com/en-us/dynamics365/finance/fixed-assets/acquire-assets-procurement

NEW QUESTION 255

A company uses Microsoft Dynamics 365 Finance and Dynamics 365 Project Operations. The company must be able to estimate the costs of a project and create a fixed asset by using the project cost estimate. You need to ensure that the company can create a fixed asset from a project. Which project type should you use?

A. Time and material.

B. Cost.

C. Internal.

D. Investment.

E. Fixed price.

Answer: D

Explanation:

Investment projects are projects that do not produce immediate earnings. They are typically used for long-term internal projects in which the costs have to be capitalized. The following are also true of investment projects:

– Only costs for items, hours, and expenses can be recorded for an investment project.

– Costs in an investment project are tracked and controlled by using the Project management and accounting Estimate feature.

– Investment projects can be set up with an optional maximum capitalization limit.

As an investment project progresses, you record its costs in WIP accounts, where the costs are held until the project is completed. When the project is eliminated, you transfer the WIP value to a fixed asset, a ledger account, or a new project.

https://docs.microsoft.com/en-us/dynamicsax-2012/appuser-itpro/about-project-types

NEW QUESTION 256

Your company uses Dynamics 365 Finance. All fixed assets are categorized by asset type. For example, office furniture is sequentially numbered, has the same service life, and uses the same depreciation deduction calculation. You need to configure the system. Which two parameters should you set up? (Each correct answer presents part of the solution. Choose two.)

A. depreciation convention

B. derived book

C. depreciation profile

D. fixed asset group

Answer: AD

Explanation:

Depreciation conventions are used to determine when and how depreciation is calculated for both the year when the fixed asset is acquired and the year when the fixed asset is disposed of. Depreciation conventions can be assigned to the setup for a fixed asset group book.

https://docs.microsoft.com/en-us/dynamics365/finance/fixed-assets/fixed-asset-depreciation-conventions

NEW QUESTION 257

HotSpot

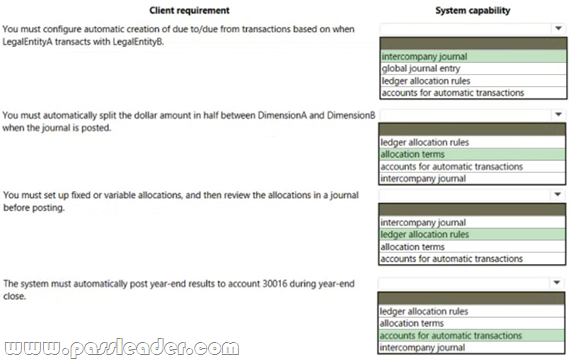

You are implementing a Dynamics 365 Finance general ledger module for a client that has multiple legal entities. The client has the following requirements:

– Post journal entries for all companies from one legal entity.

– Configure automatic creation of due to/due from transactions based on when LegalEntityA transacts with LegalEntityB.

– Automatically split the dollar amount in half between DimensionA and DimensionB when the journal is posted.

– Set up fixed or variable allocations, and then review the allocations in a journal before posting.

– Automatically post yearend results to account 30016 during yearend close.

You need to configure the system. Which system capability should you configure? (To answer, select the appropriate configuration in the answer area.)

Answer:

Explanation:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/main-account-allocation-terms

NEW QUESTION 258

HotSpot

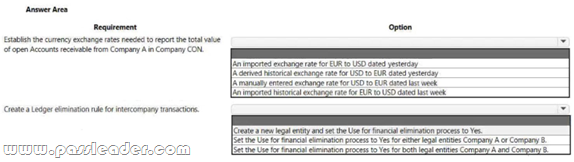

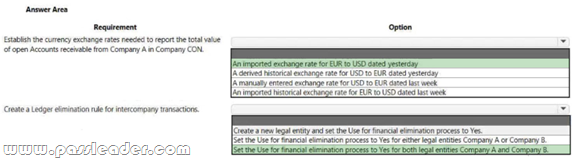

A company is implementing Dynamics 365 Finance. The company must be able to record sales orders in the following currencies: USD. EUR. and GBP.

– Company A uses USD as the accounting and reporting currency.

– Company B uses GBP as the accounting and reporting currency.

– Each company is consolidated into Company CON that uses EUR as the accounting and reporting currency.

Assets and liabilities are revalued at the current exchange rate. You need to configure the system to meet the requirements. Which option should you use? (To answer, select the appropriate options in the answer area.)

Answer:

Explanation:

Box 1: An imported exchange rate for EUR to USD dated yesterday. If a legal entity has received invoices in foreign currencies, the foreign currency must be converted into the local currency. This means that up-to-date exchange rates for different currencies are required. Before you can import exchange rates, you must set up the information that is required by the providers who offer the exchange rates. Use the Configure exchange rate providers page to select the exchange rate providers. Import as of – This parameter manages whether to import as of the current date or for a specific date range. If you want to use a date range, enter or select the start and end dates.

Box 2: Set the Use for financial elimination process to Yes for both legal entities Company A and Company B. The setup for eliminations is found in the Setup area of the Consolidations module. After you enter a description for the rule, you must pick the company that the elimination journal will post to. This should be a company that has Use for financial elimination process selected in the Legal entity setup. Note: Elimination rules can be set up in the system, and then processed during the consolidation process or through an elimination proposal. The rules can be posted to any company that has Use for financial elimination process selected in the legal entity setup.

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/import-currency-exchange-rates

https://docs.microsoft.com/en-us/dynamics365/finance/budgeting/consolidation-elimination-overview

NEW QUESTION 259

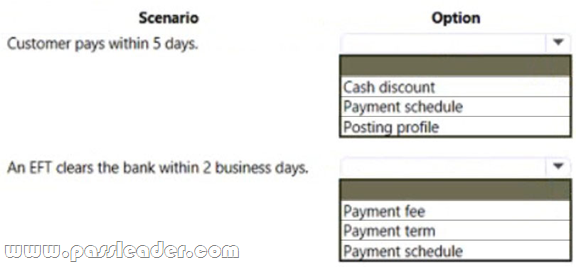

HotSpot

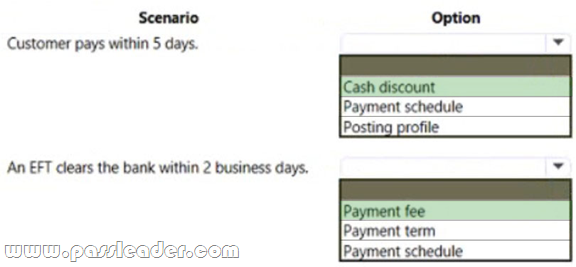

A company manufactures air filtering units for industrial manufacturing plants. The company offers specific incentives if customers pay within a certain number of days to include:

– 10 percent off if paid in full within 5 days.

– 5 percent off if paid in full within 10 days.

Customers who pay by electronic funds transfer (EFT) will be charged $15 per transfer. You need to configure the system. Which option should you use? (To answer, select the appropriate configuration in the answer area.)

Answer:

Explanation:

Box 1: Cash discount. Cash discounts are setup and shared for Accounts payable and Accounts receivable. The cash discount available can be defined on the customer invoice or vendor invoice, and will be taken if the invoice is paid within the cash discount date.

Box 2: Payment fee. You can create payment fees for customer payments.

https://docs.microsoft.com/en-us/dynamics365/finance/cash-bank-management/cash-discounts

NEW QUESTION 260

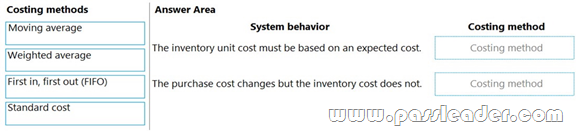

Drag and Drop

You are implementing Dynamics 365 Finance. You must associate items with an item model group. An inventory close must not be required. You need to configure the item model group. Which costing method should you use? (To answer, drag the appropriate costing method to the correct system behavior. Each costing method may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.)

Answer:

Explanation:

Box 1: Standard cost. Standard costs are estimates of the cost of goods sold — that is, the cost required to produce your products. They usually consist of three parts: direct materials, direct labor, and manufacturing overhead.

Box 2: Moving average. Moving average is a perpetual costing method based on the average principle, where the costs on inventory issues do not change when the purchase cost does.

Incorrect:

* Weighted average is an inventory model based on an average that results from the multiplication of each component (item transaction) by a factor (cost price) reflecting its importance (quantity). Another way to say this is that weighted average is an inventory model that assigns the cost of issue transactions based on the mean value of all inventory received during the period, plus any on-hand inventory from the previous period.

* First in, First out (FIFO) is an inventory model in which the first acquired receipts are issued first. Financially updated issues from inventory are settled against the first financially updated receipts into inventory, based on the financial date of the inventory transaction.

https://www.fool.com/the-ascent/small-business/accounting/articles/standard-cost/

https://docs.microsoft.com/en-us/dynamics365/supply-chain/cost-management/moving-average

NEW QUESTION 261

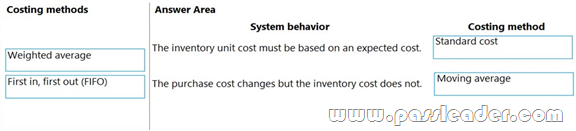

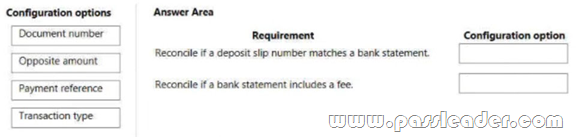

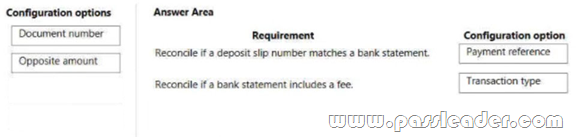

Drag and Drop

A customer implements Dynamics 365 Finance. You need to configure bank reconciliation settings. What should you do? (To answer, drag the appropriate configuration options to the correct requirements. Each configuration option may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.)

Answer:

Explanation:

https://community.dynamics.com/ax/b/happyd365fo/posts/deposit-slip-and-bridged-transactions-to-address-bank-card-oayment-provider-fees-in-bank-statement-and-bank-reconciliation-in-microsoft-dynamics-365-finance-and-operations

https://docs.microsoft.com/en-us/dynamics365/finance/cash-bank-management/reconcile-bank-account

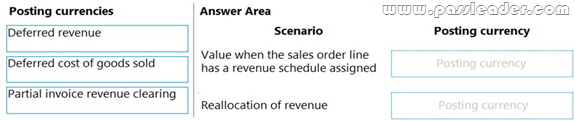

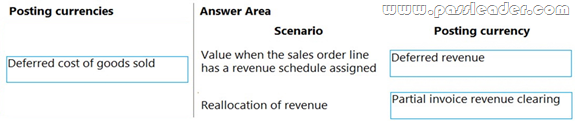

NEW QUESTION 262

Drag and Drop

You have implemented Dynamics 365 Finance. You must configure revenue recognition to handle deferring revenue and revenue reallocation. You need to configure the posting profile. What should you do? (To answer, drag the appropriate posting profiles to the correct scenario. Each posting profile may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.)

Answer:

Explanation:

Box 1: Deferred revenue. Deferred revenue – Enter the main account for the revenue price that posts to deferred revenue (instead of revenue). The revenue price is deferred if the sales order line has a revenue schedule.

Box 2: Partial invoice revenue clearing. Partial invoice revenue clearing – Enter the main account for the clearing account that is used either when the sales order is partially invoiced or when reallocation occurs. The balance in this account returns to 0 (zero) when the sales orders are fully invoiced.

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/revenue-recognition-setup

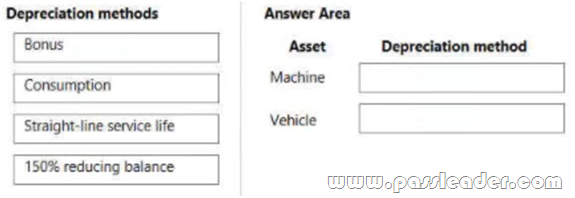

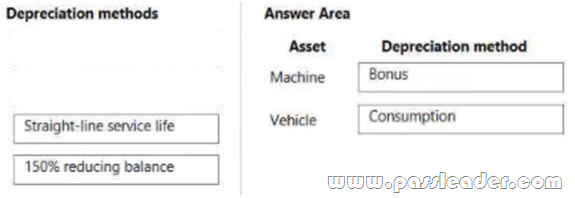

NEW QUESTION 263

Drag and Drop

A company is implementing Microsoft Dynamics 365 Finance. The company is configuring the fixed asset functionality and has the following requirements:

– Manually add an additional depreciation amount the first year a machine is put in service.

– Depreciate a company vehicle based on the number of miles it has traveled.

You need to configure the depreciation for the assets. Which depreciation method should you use? (To answer, drag the appropriate depreciation methods to the correct assets. Each method may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.)

Answer:

Explanation:

Box 1: Bonus. Manually add an additional depreciation amount the first year a machine is put in service. For bonus depreciation, you can take extra or bonus depreciation amounts during the first year that the asset is put in service and depreciated. Bonus depreciation must be taken before any other depreciation calculations.

Box 2: Consumption. Depreciate a company vehicle based on the number of miles it has traveled. If you set up a depreciation profile for fixed assets and select Consumption in the Method field on the Depreciation profiles page, fixed assets are assigned to the depreciation profile based on their usage. You don’t have to set up percentages and intervals on the Depreciation profiles page. After you create a depreciation profile that uses the Consumption method, you can set up the method in various ways.

https://docs.microsoft.com/en-us/dynamics365/finance/fixed-assets/bonus-depreciation

https://docs.microsoft.com/en-us/dynamics365/finance/fixed-assets/consumption-depreciation

NEW QUESTION 264

……

Get the newest PassLeader MB-310 VCE dumps here: https://www.passleader.com/mb-310.html (343 Q&As Dumps)

And, DOWNLOAD the newest PassLeader MB-310 PDF dumps from Cloud Storage for free: https://drive.google.com/open?id=1T0aRKKPZq4mi2lMl-DzV0wAUTYC-MPX1