Valid MB-310 Dumps shared by PassLeader for Helping Passing MB-310 Exam! PassLeader now offer the newest MB-310 VCE dumps and MB-310 PDF dumps, the PassLeader MB-310 exam questions have been updated and ANSWERS have been corrected, get the newest PassLeader MB-310 dumps with VCE and PDF here: https://www.passleader.com/mb-310.html (132 Q&As Dumps –> 159 Q&As Dumps –> 188 Q&As Dumps –> 343 Q&As Dumps)

BTW, DOWNLOAD part of PassLeader MB-310 dumps from Cloud Storage: https://drive.google.com/open?id=1T0aRKKPZq4mi2lMl-DzV0wAUTYC-MPX1

NEW QUESTION 111

You are a Dynamics 365 Finance expert for an organization. You need to configure the Financial period close workspace. Which three configuration processes should you use? (Each correct answer presents a part of the solution. Choose three.)

A. Create templates that contain the required tasks within the closing process and assign to closing role.

B. Create a separate closing schedule for every legal entity.

C. Assign a ledger calendar to the closing process.

D. Create task areas and descriptions.

E. Designate resources and their scope based on closing roles.

Answer: ADE

Explanation:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/financial-period-close-workspace

NEW QUESTION 112

You are a Dynamics 365 Finance consultant. You are currently unable to collaborate or track progress toward month-end close across legal entities in the current system. You need to resolve the issue. What should you configure?

A. Financial reporting

B. Financial insights workspace

C. Electronic reporting

D. Financial period close workspace

Answer: D

Explanation:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/financial-period-close-workspace

NEW QUESTION 113

You are a Dynamics 365 Finance consultant. You plan to configure the allocation base, cost behavior, and cost distribution. Which three actions do these configurations accomplish? (Each correct answer presents a complete solution. Choose three.)

A. Spread costs from one cost object to one or more other cost objects by applying a relevant allocation base.

B. Measure and quantify activities, such as machine hours that are used, kilowatt hours that are consumed, or square footage that is occupied.

C. Spread the balance of the cost from one cost object to one or more other cost objects by applying a relevant allocation base.

D. Control which journals can be used in the costing process.

E. Classify costs according to their behavior in relation to changes in key business activities.

Answer: ABE

Explanation:

https://docs.microsoft.com/en-us/dynamics365/finance/cost-accounting/terms-cost-accounting

NEW QUESTION 114

You are a finance consultant. Your client needs you to configure cash flow forecasting. The client wants specific percentages of main accounts to contribute to different cash flow forecasts for other main accounts. You need to configure Dynamics 365 for Finance to meet the needs of the client. What should you do?

A. On the Cash flow forecasting setup form, configure the primary main account to assign a percentage to the dependent account.

B. Configure the parent/child relationship for the main account and subaccounts by using appropriate percentages.

C. Configure the cash flow forecasting setup for Accounts Payable before you configure vendor posting profiles.

D. On the Cash flow forecasting setup form, use the Dependent Accounts setup to specify which account and percentage is associated to the main account.

Answer: D

Explanation:

https://docs.microsoft.com/en-us/dynamics365/finance/cash-bank-management/cash-flow-forecasting

NEW QUESTION 115

A company plans to use Dynamics 365 Finance to calculate sales tax on sales orders. You need to automatically calculate sales tax when the sales order is created. Which three actions should you perform? (Each correct answer presents part of the solution. Choose three.)

A. Assign values to the sales tax codes and assign the sales tax codes to the sales tax group associated to the customer.

B. Assign all sales tax codes to the item sales tax group associated to the item being sold.

C. Set up a default item sales tax group on the item being sold and set up a default sales tax group on the customer used on the sales order.

D. Associate the sales tax jurisdictions to the item sales tax group associated to the item being sold.

E. Set up a default sales tax code on the customer used on the sales order and set up a default item sales tax group on the item being sold.

Answer: ABE

Explanation:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/indirect-taxes-overview

NEW QUESTION 116

You are setting up the Accounts payable module and vendor invoice policies for an organization. You need to set up vendor invoice policies that run when vendor invoices are posted in the system. In which two ways can you set up the policies? (Each correct answer presents a complete solution. Choose two.)

A. Set up invoice matching validation for vendor invoice policy.

B. Configure the vendor invoice workflow to run the policies.

C. Run the policies when you post a vendor invoice by using the Vendor invoice page and when you open the Vendor invoice policy violations page.

D. Apply the policies to invoices that were created in the invoice register or invoice journal.

Answer: BC

Explanation:

https://docs.microsoft.com/en-us/dynamicsax-2012/appuser-itpro/key-tasks-vendor-invoice-policies

NEW QUESTION 117

A company has many customers who are not paying invoices on time. You need to use the collection letter functionality to manage customer delinquencies. What are two possible ways to achieve the goal? (Each correct answer presents part of the solution. Choose two.)

A. Cancel the collection letters after they are created and posted.

B. Print all of the collection letters.

C. Delete the collection letters after posting when an error occurs.

D. Post the collection letters.

Answer: BD

Explanation:

http://d365tour.com/en/microsoft-dynamics-d365o/finance-d365fo-en/collection-letters/

NEW QUESTION 118

You are configuring vendor collaboration security roles for external vendors. You manually set up a vendor contact. You need to assign the Vendor (external) role to this vendor. Which tasks can this vendor perform?

A. Request a new user account for a contact person by using the Provision user action.

B. Maintain vendor collaboration invoices.

C. Delete any contact person that they have created.

D. View and modify contact person information, such as the person’s title, email address, and telephone number.

Answer: B

Explanation:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/supply-chain/procurement/set-up-maintain-vendor-collaboration

NEW QUESTION 119

You are configuring the basic budgeting for a Dynamics 365 Finance environment. You need to configure the types of entries allowed. Which two configurations can you use? (Each correct answer presents a complete solution. Choose two.)

A. The budget register entry journals require both Expense and Revenue amount types.

B. Budget register entry line needs a main account and amount to be valid.

C. Budget register entry journals must be allocated across all fiscal periods.

D. Budget register entry lines must select only one account structure.

E. The budget register entries can contain either Expense or Revenue amount types.

Answer: DE

NEW QUESTION 120

A company is preparing to complete yearly budgets. The company plans to use the Budget module in Dynamics 365 Finance for budget management. You need to create the new budgets. What should you do?

A. Create budget plans for multiple scenarios.

B. Create budget plans to define the revenues for a budget.

C. Combine previous year budgets into a single budget.

Answer: A

Explanation:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/budgeting/budget-planning-overview-configuration

NEW QUESTION 121

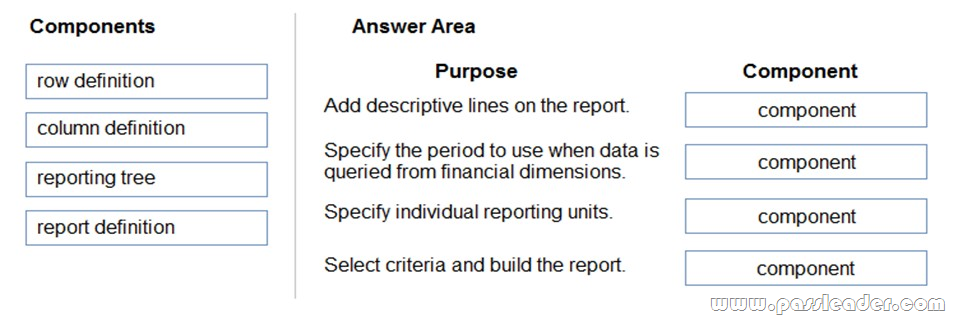

Drag and Drop

A client plans to use financial statements in Dynamics 365 Finance. The client wants to process the statements by using various combinations of the components to create custom reports. You need to associate the report components to the purpose. Which report components should you use for each purpose? (To answer, drag the appropriate component to the correct purpose. Each component may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.)

Answer:

Explanation:

https://docs.microsoft.com/en-us/dynamics365/fin-ops-core/dev-itpro/analytics/financial-report-components

NEW QUESTION 122

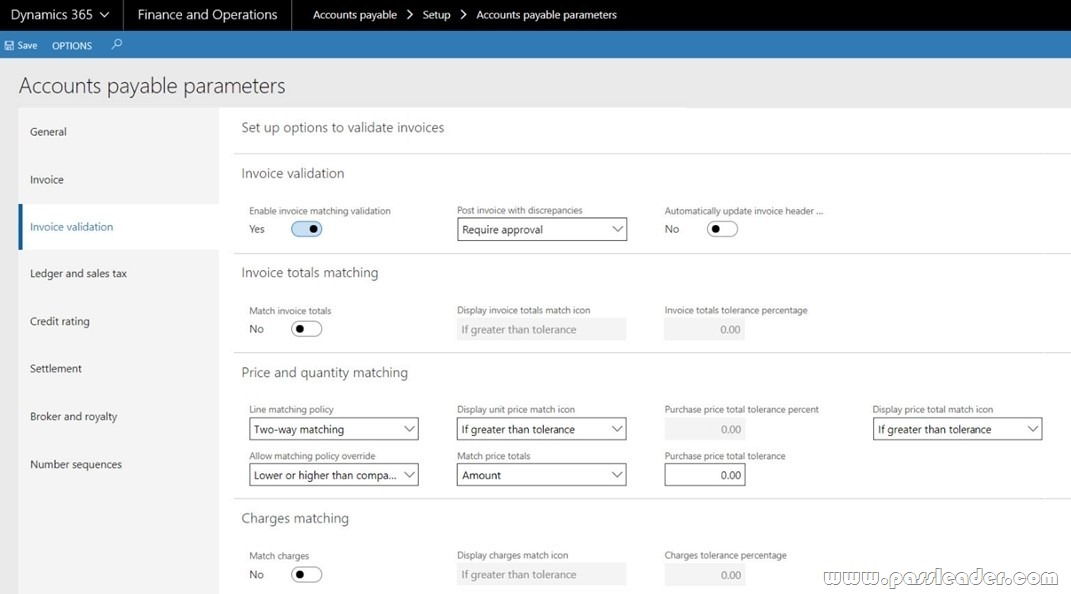

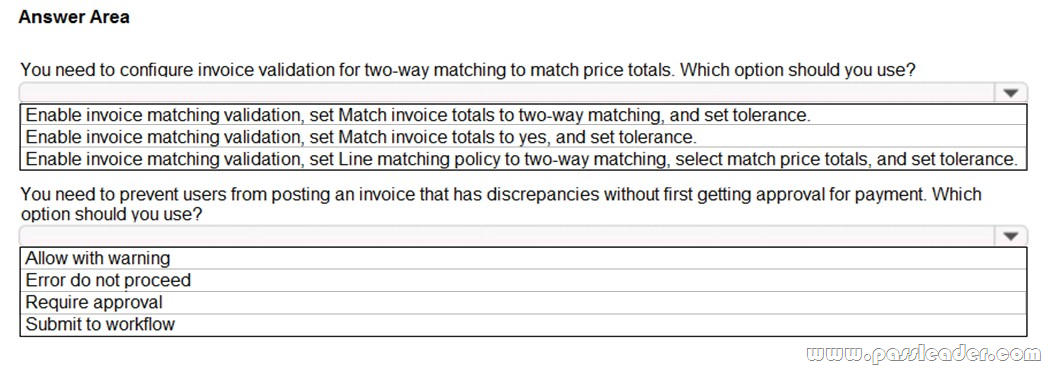

Hotspot

You need to configure invoice validation for vendors in Dynamics 365 Finance. You are viewing the Accounts payable parameter for Invoice validation.

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

Answer:

Explanation:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-payable/tasks/set-up-accounts-payable-invoice-matching-validation

Case Study – Fourth Coffee

Fourth Coffee is a coffee and supplies manufacturer based in Seattle. The company recently purchased CompanyA, based in the United States, and CompanyB, based in Canada, in order to increase production of their award-winning espresso machine and distribution of their dark roast coffee beans, respectively.

……

NEW QUESTION 123

You need to configure settings to resolve User8’s issue. What should you select?

A. a main account in the sales tax payable field

B. a main account in the settlement account field

C. the Conditional sales tax checkbox

D. the Standard sales tax checkbox

Answer: B

NEW QUESTION 124

You need to view the results of Fourth Coffee Holding Company’s consolidation. Which three places show the results of financial consolidation? (Each correct answer presents a complete solution. Choose three.)

A. a financial report run against the company Fourth Coffee

B. a trial balance in the Fourth Coffee Holding Company

C. a trial balance in the company Fourth Coffee

D. a financial report run against the Fourth Coffee Holding Company

E. the consolidations form in Fourth Coffee Holding Company

Answer: BDE

NEW QUESTION 125

……

Case Study – Munson

Munson’s Pickles and Preserves Farm grows and distributes produce, jellies, and jams. The company’s corporate headquarters is located in Dallas, TX. Munson’s has one operations center and seven regional distribution centers in the United States. The company has two wholly owned subsidiaries that operate in Canada. The Canadian entity owns an entity in France.

……

NEW QUESTION 128

You need to configure system functionality for pickle type reporting. What should you use?

A. item model groups

B. item groups

C. procurement category hierarchies

D. financial dimensions

E. procurement categories

Answer: B

NEW QUESTION 129

You need to recommend a solution to prevent User3’s issue from recurring. What should you recommend?

A. Configure automatic charge codes.

B. Create a service item.

C. Configure a sales order template.

D. Create a procurement category.

Answer: A

NEW QUESTION 130

……

Get the newest PassLeader MB-310 VCE dumps here: https://www.passleader.com/mb-310.html (132 Q&As Dumps –> 159 Q&As Dumps –> 188 Q&As Dumps –> 343 Q&As Dumps)

And, DOWNLOAD the newest PassLeader MB-310 PDF dumps from Cloud Storage for free: https://drive.google.com/open?id=1T0aRKKPZq4mi2lMl-DzV0wAUTYC-MPX1